Let's Talk Money

We're getting our first look at the near $94 million budget for the 2023-24 Fiscal Year

In a room with a mix of town employees and residents, Holly Springs Town Manager Randy Harrington laid out the $93.8 million budget for the next fiscal year. The meeting was just a presentation. No one could ask questions. The next two meetings — one designed for residents — will give people a chance to ask questions and provide feedback.

My opinion: I strongly suggest everyone at least review the videos that explained the whys of the two major budget issues: water and the bond.

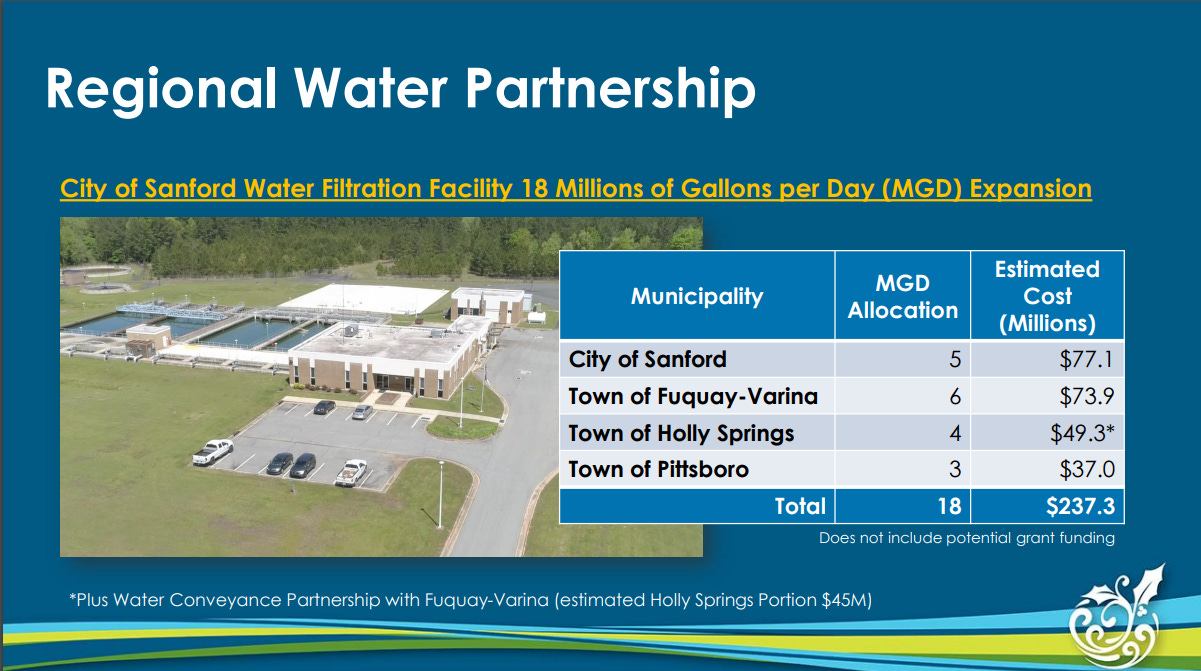

The water/sewer increase of nearly 15% will cover the costs of a regional partnership to build a water treatment facility. The Holly Springs portion would be $49.3 million of the $237.3 million cost to build the facility.

The town also wants to upgrade the current wastewater treatment plant to expand its use. The expansion would help as the town continues to add residents and businesses.

The budget does include upgrades to emergency services, hiring staff, and retaining staff to make the town’s pay more competitive.

I’ve written about the parks bond several times. Click on the links here and here.

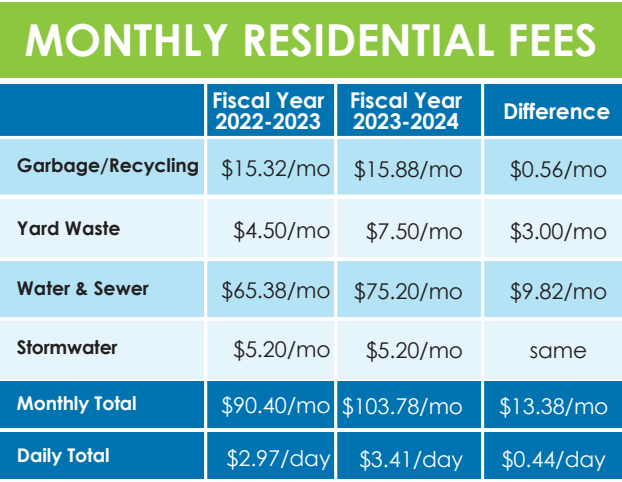

Ok, let’s get to the part for anyone who pays bills each month really cares about… how much more will I be paying?

First, Harrington said he isn’t calling for an overall property tax hike for the town. Wake County is calling for one (I’ll include that after evaluating the town increases).

Your water/sewer bill is looking at a $13.38 per month increase ($160.56/year).

If the bond passes in November, there will be a 5-cent property tax increase. During the presentation, town manager Randy Harrington mentioned the tax increase could to change in future budgets.

This bond would be set for a 20-year period of time. If it passes, a home worth $400,000 would see an additional $200 per year in property taxes.

A nifty property tax calculator explainer

So far a year:

Water/Sewer: $160.56

Bond tax: $200

= $360.56 estimated increase per year

Wake County is proposing a 3.25-cent property tax hike. The county says the $1.8 Billion budget includes an increase of spending for the school system, Wake Tech, infrastructure and affordable housing.

If the tax hike is approved, it would bring the tax rate for the county at 65.2-cents per $100 of property value. The current rate is 61.95-cents. The difference annually will be $130 using the $400,000 home value example.

Holly Springs increase: $360.56

Wake County increase: $130

= $490.56 estimated increase per year

The fiscal year starts July 1.

A public hearing is set for May 16th at 7pm in Town Hall.